Handsome revenues, delivered quickly and in swelling amounts. Prospective for fast and large returns. If you view HGTV, you understand the drill. First, purchase a slightly "distressed" residential or commercial property in an up-and-coming area for less than market price or less than its near-future worth. Next, refurbish this fixer-upper into a design house.

Rinse and repeat. High benefits come with high threat. Big returns can be misleading. Sometimes, they don't consist of all the expenses of obtaining and renovating the home. what jobs Click here can you get with a finance degree. These costs generally swallow 20% to 30% of revenues. In addition to renovation expenses, you'll pay closing expenses, residential or commercial property taxes, insurance and (typically) a real estate agent's fee.

Unless you have great deals of cash on hand, you'll require a short-term loan to purchase the property. Regrettably, the requirements for investment home loans are more stringent than those for main residencesand are often far more costly. Your earnings will be subject to capital gains taxes. Long-term capital gains (financial investments held for a year or longer) are taxed at a rate of 10% to 15%, however short-term capital gains are taxed at the same rate as ordinary earnings.

The most significant mistake made by many newbie home flippers is undervaluing the cost of buying and sprucing up the property. As a house flipper, you're betting you can sell the renovated house at a significant markup before ever-escalating costs damage your earnings margin. This isn't a game for nave or impatient people.

5 Easy Facts About What Is A Consumer Finance Company Explained

The ideal community is one where houses are still affordable but appreciating quickly. Whether you buy an apartment building or duplex, the greatest benefit of rental residential or commercial property is the predictable income stream that it creates. Whereas a three-month house flip endeavor might produce a $50,000 gross revenue on a $200,000 financial investment, a $200,000 rental home could generate, state, $1,000 a month after expenses.

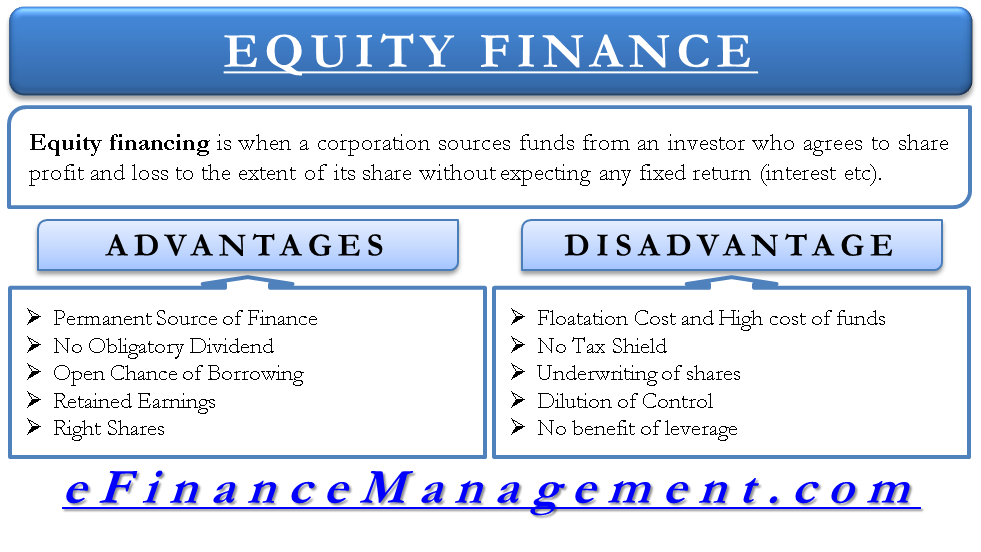

They'll keep gathering month after month, every year. In addition to creating revenue, rental income will help you pay down the loan you got to fund the residential or commercial property. And in some cases, current and future rental earnings The original source assists you receive more beneficial loan terms. The best perk of owning rental residential or commercial property might be the tax advantages.

Typical deductions consist of money spent on mortgage interest, repairs and upkeep, insurance, home taxes, travel, lawn care, losses from casualties (floods, typhoons, and so on), as well as HOA charges and condominium or co-op maintenance fees. how to start a finance company. If net capital isn't favorable after subtracting costs, your rental income may even be tax totally free! If you've ever invested time talking with a property owner, you know that owning rental residential or commercial property is not without its headaches and troubles.

( Most properties are in the 37% to 45% variety. If your expense estimates fall far below this, double-check your calculations.) Numerous brand-new landlords ignore the cost of owning and maintaining their properties. (Note: costs might not be completely tax deductible. It depends on whether the IRS categorizes your rental income as "non-passive" or "passive." If you do not spend a minimum of 750 hours a year working on your rental properties, any losses are passive and only deductible as much as $25,000 versus the leasings' income.

Fascination About How To Finance A House Flip

If you're not useful, or do not desire to field midnight calls from occupants, you'll require to hire a residential or commercial property management business to manage such jobs. The good news is that property management firms can handle some (and even all) the unpleasant chores from keeping units inhabited to supervising repair work and maintenance, collecting rents, finding reliable brand-new tenants and forcing out deadbeats.

They will likewise be professionals in the landlord tenant laws of your city and state. But these services aren't free. Anticipate to pay a management firm a month-to-month cost of 7% to 10% of the leas gathered. Furthermore, some home management companies charge extra fees for performing or supervising repairs, for locating new tenants, and even when a tenant restores the lease.

There is likewise the danger of a deadbeat occupant who damages your residential or commercial property, however takes months to force out. Carefully screening potential occupants and purchasing home in stable, middle-class communities can minimize your threat of long-term vacancies and non-paying renters, but there's no guarantee you won't face these problems. The very best financial investment property funding for you will depend on your specific financial circumstance.

Contact several loan providers, beginning with the bank that provided your first mortgage, to compare interest rates and terms, as well as the closing expenses and other charges. Always read the "small print" to uncover any big charges and additional costs, consisting of extra costs triggered by the variety of existing loans/mortgages you already have.

6 Simple Techniques For How Many Months Can You Finance A Used Car

In many cases, it might also make good sense to pay in advance charges (" points") to decrease the rate. If you get a big loan, and strategy to hold the property for a long time, paying upfront fees and/or a greater deposit could trim thousands of dollars from your payment total.

If your score is a bit anemic, takes actions to enhance the rating e. g., by paying down (or settling) as much debt as possible. Be sure you have adequate reserves of cash or other liquid properties. Six months' money reserves are generally required to receive financial investment home home loans.

For instance, what would you do if your business made you relocate while you were in the middle of a fix-and-flip venture? Did you obtain enough to work with specialists to end up the job? (If so, by how much would that decrease your earnings and ability to repay the loan?) Determine how much property you can pay for, and stick to your budget plan.

If you purchase just those properties you can pay for, cost overruns might result in annoyance and a small decrease of your revenue margins. If you fall in love with a home and surpass your cost caps, vacation ownership group llc any extra cost may spell disaster. Should you flip homes or purchase rental properties? It all depends upon your objectives, and to what degree you can take advantage of your abilities, know-how (building skills are very valuable) and your current monetary scenario.

The Single Strategy To Use For How Old Of A Car Can You Finance

Although price devaluation is never a good idea for homeowner, stable and/or falling prices have less effect on someone whose primary source of income originates from rents versus a fast resale of a residential or commercial property. In mid-2017, the greatest flipping returns remained in Pittsburgh, at 146. 6%; Baton Rouge, LA, at 120.

3%; and Cleveland, at 101. 8%, according to ATTOM Data Solutions. These cities topped the list since they had lots of budget friendly, older houses that might be rapidly renovated. At the exact same time, real estate prices there were likewise increasing. For rental properties, the very best markets in early 2017 were Cleveland, with an 11.

8%; Columbia, SC, at 8. 6%; Memphis, TN, at 8. 5%; and Richmond, VA, at 8. 2%. The worst markets were typically located in the most significant cities on either coast, where realty costs have long been sky high. However regional markets are constantly altering. Like any other type of financial investment, real estate brings both risks and rewards.